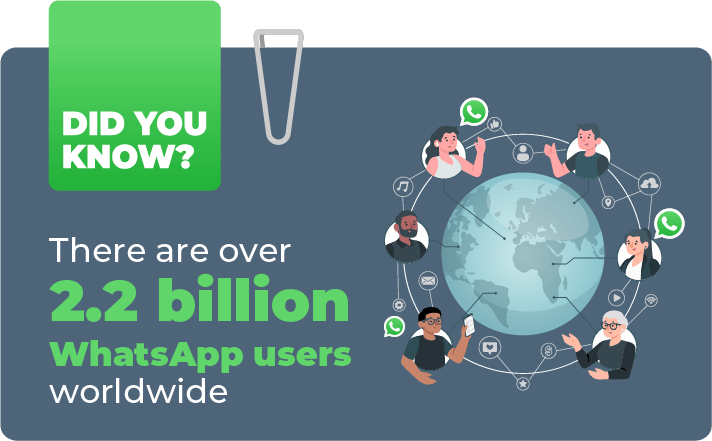

Nearly half of the world’s population uses WhatsApp, and as of February this year, the messaging service now supports voice calls, opening up a whole new avenue for business. Banks and insurance companies can use the platform to build relationships with customers and prospects by creating mobile-friendly customer care services available 24/7, reaching millions of people in the palm of their hands in real-time conversations – regardless of location or time zone differences. In fact, 1 in 5 users on WhatsApp is active every day!

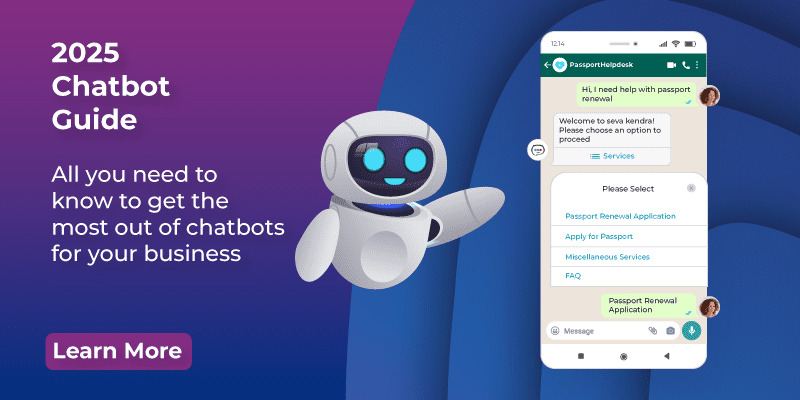

Read on to find out how WhatsApp Business API can benefit your company and how to get started quickly and easily!

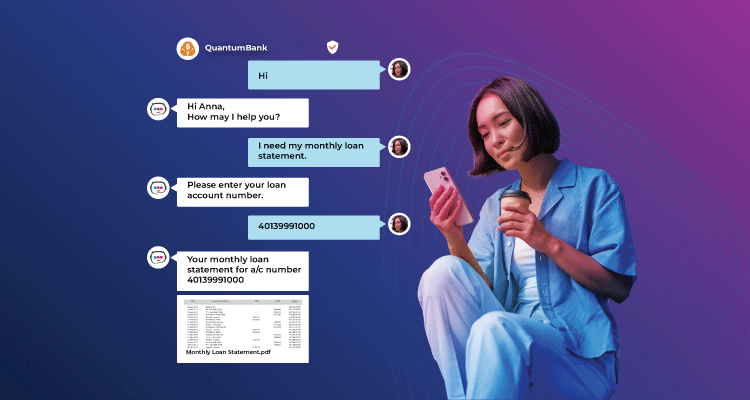

Become a trusted source of customer service

Financial institutions can use the WhatsApp Business platform to offer customers 24-hour customer service. If customers want to contact a financial institution, they can do so at any time of day or night and receive a prompt response, no matter where they are in the world. This is important because it gives customers the confidence that their financial institutions are there for them whenever they need them.

Additionally, using this platform is cost-effective and doesn’t require expensive tools like call centres. Instead, all you need is a website with a chat function. Plus, as more people start using social media as their primary mode of communication, this option will be an increasingly popular way for people to communicate with their banks.

Grow customer base

Financial institutions should consider how they can use the WhatsApp Business Platform to grow their customer base. The global messaging platform is used by over 1 billion people worldwide and has become a trusted communication channel for many of its users. It has also helped small businesses grow into successful enterprises as message opening rates reach 98% on WhatsApp. WhatsApp Business Platform also offers a wide range of features that financial institutions can use to provide better services and stay engaged with their customers.

Reduce the cost of customer acquisition

With each new customer that is acquired, the cost of acquiring another customer increases. This will naturally happen as the number of people who are potential customers decreases. With the WhatsApp business platform, financial institutions can reduce the cost of customer acquisition by expanding their reach to new markets and leveraging on the existing network of over a billion active users. Other benefits, such as increased engagement and higher conversion rates, will help generate more revenue for banks.

Better Security

One of the most important benefits is that the app has a better level of security. Unlike other apps, WhatsApp does not store users’ data on their servers. The company encrypts all conversations using end-to-end encryption, which means that only you and your contact can read what’s being shared. This is not possible with Facebook Messenger or Gmail, for example.

Give customers 24/7 customer service

Customers expect more and more these days, which is why companies like Burger King have started offering a hotline for people who are already in their stores. In this age of convenience, the most important part of good customer service is being able to provide it at all times. That’s where WhatsApp comes in. With the new platform, users can reach out to companies with questions 24 hours a day, seven days a week. Plus, messages are encrypted end-to-end, and you’re given an option to delete any messages from your company’s chat box after you’ve read them so that there won’t be any confusion about what was said between both parties at any time.

End Note:

WhatsApp is an instant messaging service with a huge number of active users worldwide. With over 1 billion active users, WhatsApps user base is far greater than any other comparable service. This makes it an appealing platform for financial institutions to reach their customers. Contact Us Now to learn more about the Whatsapp Business Platform.