In today’s fast-paced digital world, the banking sector is continually evolving to meet the demands of tech-savvy customers. One of the significant advancements in this sector is the integration of chatbots. Specifically, WhatsApp chatbots have emerged as a powerful tool for enhancing customer experience and streamlining banking operations. WhatsApp, with its vast user base, provides a familiar and convenient platform for customers to interact with their banks, making banking services more accessible and efficient.

Summary:

- Role of Chatbot in Modern Banking

- WhatsApp Chatbot: The Future of Banking

- How to Set Up Your WhatsApp banking Chatbot: A Comprehensive Guide

- Best Practises for a Successful WhatsApp Chatbot

- 10 USe Cases for WhatsApp Chatbots in Banking

- Frequently Asked Questions (FAQs) about WhatsApp Chatbots in Banking

- Getting Started with WhatsApp Business Platform

I. Role of Chatbot in Modern Banking

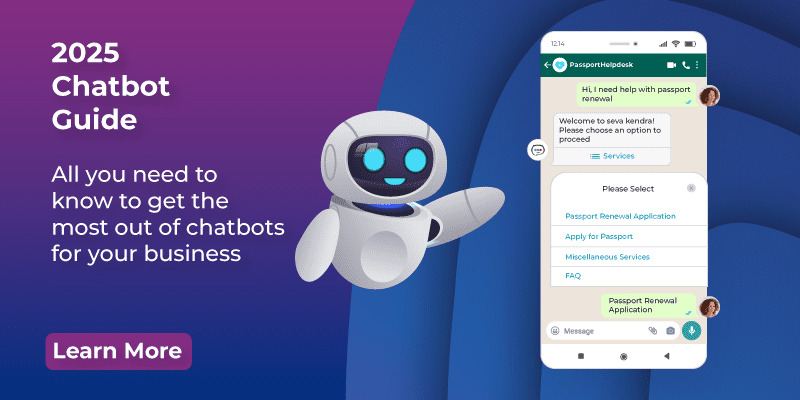

Chatbots, powered by artificial intelligence (AI), can handle a multitude of tasks that previously required human intervention. These tasks include answering queries, processing transactions, providing information on products and services, and much more. By leveraging the power of chatbots, banks can offer 24/7 customer support, reduce operational costs, and improve customer satisfaction.

II. WhatsApp Chatbot: The Future of Banking

WhatsApp chatbots represent the future of banking by bridging the gap between traditional banking and digital solutions. They offer a seamless and personalized customer experience , enabling users to perform various banking operations without leaving the chat interface. This convenience is a significant factor in the growing popularity of WhatsApp chatbots.

Moreover, the security features of WhatsApp, including end-to-end encryption, ensure that customer data and transactions are secure. This security, combined with the ease of use, makes WhatsApp chatbots an ideal solution for modern banking needs. As banks strive to meet the increasing demand for digital services, WhatsApp chatbots will play a crucial role in their digital transformation strategies.

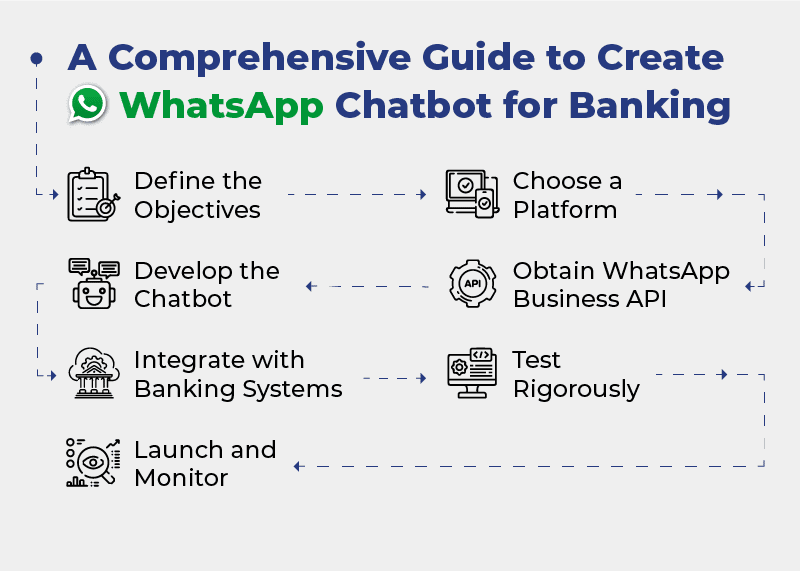

III. How to Set Up Your WhatsApp Banking Chatbot: A Comprehensive Guide

Setting up a WhatsApp banking chatbot involves several steps to ensure it meets both the technical and regulatory requirements. Here’s a comprehensive guide to help you get started:

- Define the Objectives: Determine the primary functions your chatbot will perform. Common objectives include answering FAQs, processing transactions, and providing account information.

- Choose a Platform: Select a chatbot development platform that supports WhatsApp integration.

- Obtain WhatsApp Business API: Apply for access to the WhatsApp Business API. This step is crucial as it allows your chatbot to interact with customers on WhatsApp.

- Develop the Chatbot: Collaborate with developers to build the chatbot. Ensure it is capable of natural language processing (NLP) to understand and respond to customer queries effectively.

- Integrate with Banking Systems: Connect the chatbot to your banking systems to enable transaction processing and account management functionalities

- Test Rigorously: Conduct extensive testing to ensure the chatbot operates smoothly and securely. This includes functionality, usability, and security tests.

- Launch and Monitor: Once tested, launch the chatbot and continuously monitor its performance. Gather feedback from users to make necessary improvements.

IV. Best Practices for a Successful WhatsApp Chatbot

To ensure the success of your WhatsApp banking chatbot, consider the following best practices:

- User-Friendly Interface Design the chatbot to be intuitive and easy to navigate. Ensure it can understand and respond to natural language inputs.

- Security and Privacy Implement robust security measures to protect customer data. This includes encryption, authentication, and regular security audits.

- Personalization Use AI to personalize interactions based on customer data and preferences. Personalized experiences can significantly enhance customer satisfaction.

- Continuous Improvement Regularly update the chatbot to fix bugs, improve functionalities, and incorporate user feedback.

- Compliance Ensure your chatbot complies with relevant banking regulations and data protection laws.

- Transparent Communication Clearly inform customers about what the chatbot can and cannot do. Transparency builds trust and sets realistic expectations.

V. 10 Use Cases for WhatsApp Chatbots in Banking

WhatsApp chatbots can revolutionize various aspects of banking. Here are 10 use cases demonstrating their potential:

- Account Balance Inquiry Customers can quickly check their account balance via the chatbot.

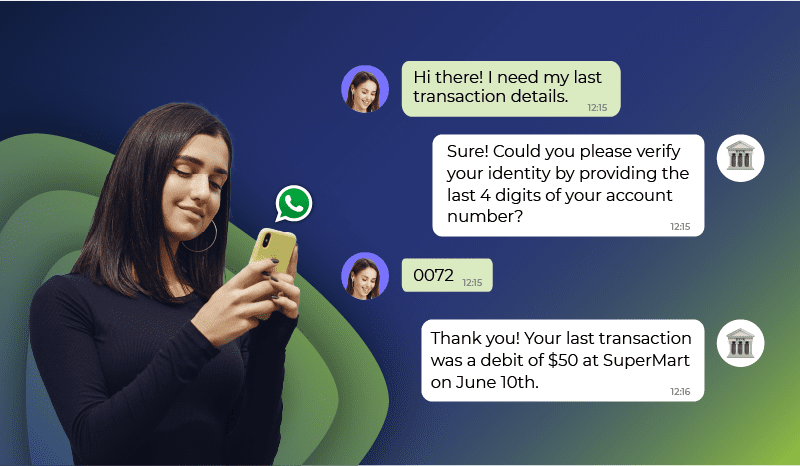

- Transaction History: Customers can request their recent transaction history.

- Fund Transfers: Facilitate easy and secure money transfers between accounts.

- Loan Applications: Assist customers in applying for loans and checking application status.

- Credit Card Services: Provide information on credit card usage, limits, and due dates.

- Branch Locator: Help customers find the nearest bank branch or ATM.

- Customer Support: Offer instant responses to common customer queries and issues.

- Investment Information: Provide details on investment options and portfolio performance.

- Fraud Alerts: Send real-time alerts regarding suspicious activities.

- Bill Payments: Enable users to pay bills directly through the chat interface.

VI. Frequently Asked Questions (FAQs) about WhatsApp Chatbots in Banking

WhatsApp chatbots can revolutionize various aspects of banking. Here are 10 use cases demonstrating their potential:

1. Are WhatsApp chatbots secure for banking?

Yes, WhatsApp chatbots utilize end-to-end encryption to ensure secure communication between the bank and its customers.

2. Can a WhatsApp chatbot handle complex banking transactions?

While chatbots are excellent for routine tasks, complex transactions may still require human intervention. However, advancements in AI are continually enhancing their capabilities.

3. How do customers interact with the chatbot?

Customers can interact with the chatbot through text messages, sending their queries or requests, to which the chatbot responds in real time

4. What if the chatbot cannot answer a question?

If the chatbot cannot handle a query, it can escalate the issue to a human representative for further assistance.

5. Is it expensive to implement a WhatsApp banking chatbot?

The cost varies depending on the chatbot’s complexity and functionalities. However, the investment is generally offset by the operational efficiencies and enhanced customer experience it provides.

VII. Getting started with WhatsApp Business Platform

As a part of this digital transformation landscape, Route Mobile takes center stage. Route Mobile’s WhatsApp Business Platform provides robust solutions tailored to the banking industry. It enhances customer engagement by offering secure and scalable communication solutions that integrate seamlessly with existing banking systems.

Current market trends indicate a significant shift towards digital banking, with customers expecting real-time, personalized service. Route Mobile’s platform addresses these needs by enabling banks to offer instant customer support, transactional capabilities, and proactive notifications through WhatsApp. As the banking industry continues to evolve, leveraging such platforms will be crucial for staying competitive and meeting customer expectations.

By adopting Route Mobile’s WhatsApp Business Platform, banks can improve operational efficiency and foster stronger customer relationships, paving the way for a future where banking is more accessible, responsive, and customer-centric.