Table of Contents:

- 8 Ways Fintech Leverage WhatsApp Business For Customer Engagement

- Ensure Seamless And Enhanced Customer Onboarding

- Send Out Regular Account Notifications

- Engage Through Time-Sensitive Alerts And Urgent Updates

- Automated Messaging

- Personalized With Customer Support

- Engage With Financial Education & Tips

- Accepting Payments Through WhatsApp

- Building Trust Through Security, Regulation And Compliance

- Conclusion

- FAQs

With the rapid adoption of digital technologies, including revolutionary artificial intelligence, the FinTech industry has undergone a tremendous transformation in recent years.

Fintech companies struggle to stay ahead of the curve to have that competitive advantage where customer engagement and user experience have become a bottleneck for all.

Mostly, this is them catching up to the consistent evolution in customer communication and marketing through AI adoption and communication solutions.

WhatsApp, since it became the most popular messaging platform, with the most monthly active users compared to any other messaging app, boasting almost 3 billion monthly users, became the best platform to maximize customer engagement.

The challenge lies with its use case and application in fintech, which we are resolving here by leveraging WhatsApp business to boost customer engagement.

8 Ways Fintech Leverage WhatsApp Business For Customer Engagement

Explore the top eight ways the Fintech industry can leverage WhatsApp Business for customer engagement:

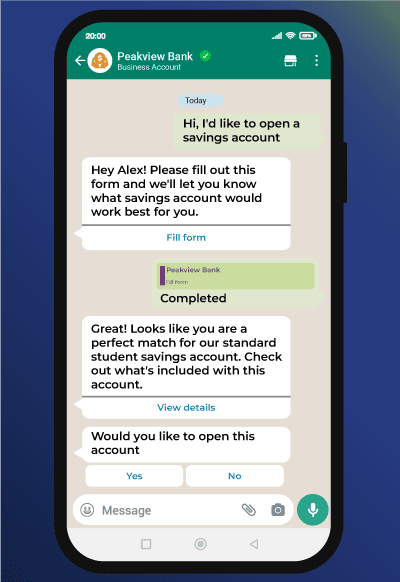

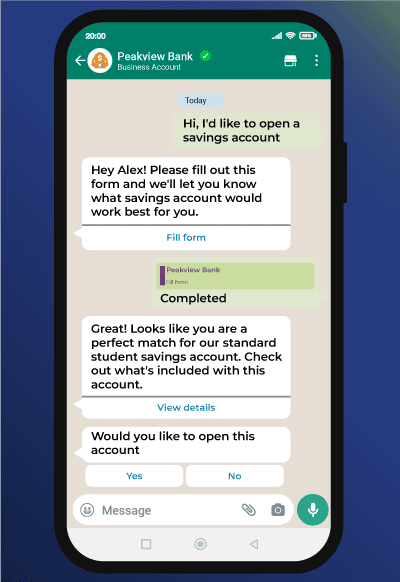

Ensure Seamless and Enhanced Customer Onboarding

WhatsApp chatbots help businesses increase lead generation by 500%. They also have lower cost-per-lead than other social media channels, with a 28% lead-to-conversation rate.

Leveraging AI chatbot technology like Route Mobile’s Roubot, fintech companies can fulfill the ideal scenario where opening a financial account is as easy as making conversations online.

And that’s where financial tech enterprises are required to optimize their customer onboarding process and make it more personalized, familiar, and convenient.

With some backend automation, you can eliminate lengthy forms, tedious paperwork, or a long line of questions. All that is left is a personal assistant, a friendly chatbot guiding your customers through the process and opening their accounts towards the end.

Must Read: Launching a WhatsApp Chatbot for Banking

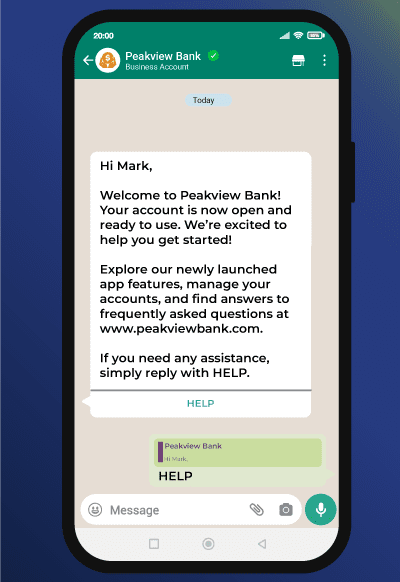

Send-Out-Regular-Account-Notifications

With a staggering 98% message open rate, WhatsApp has become the most popular messaging platform for account notifications in the fintech industry through its flexibility, advanced features, and scalability.

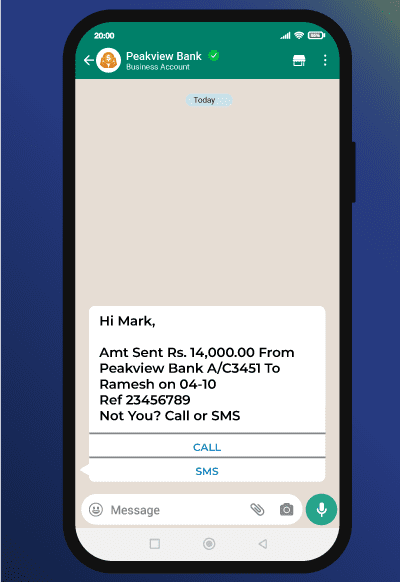

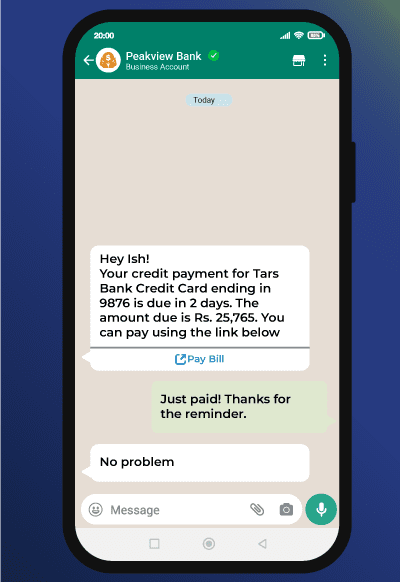

Engage Through Time-Sensitive Alerts And Urgent Updates

Through instant messages, consumers like to be informed about their financial transactions, fund transfers, investment updates, unauthorized transactions, and other time-sensitive notifications. Route Mobile offers a WhatsApp Business Messaging platform that is ideal for quickly automating such campaigns.

Automated Messaging

82% of consumers expect an instant response to sales and marketing questions. This means not automating your WhatsApp business messaging costs you a substantial amount of potential customers.

You can use automated workflows through WhatsApp API on Route Mobile’s CPaaS solution and custom chatbot Roubot to ensure consumers can instant replies to their frequently asked questions.

Also Read: The Power of WhatsApp Automation – Use Cases & Implementation

Personalized Customer Support

Through WhatsApp flows and API integration, fintech companies can address customer queries directly within the messaging app. Leveraging conversational AI, chatbots can offer automated instant responses and do more than just answer FAQs, improving customer satisfaction and boosting engagement.

Engage With Financial Education & Tips

Fintech companies can use WhatsApp messaging to empower their consumers with foundational financial knowledge. Educating is one of the best ways to engage potential prospects and customers in the long term.

Sharing personal finance wisdom and money management tips will establish your enterprise as an authority and become a go-to platform for seeking information. With WhatsApp, you can create bite-size financial tips, investment insights, and personal finance strategies that are readily available to your users.

Accepting Payments Through WhatsApp

WhatsApp Business accounts can accept customer payments using the messaging app without making them go to another website or app for checkout.

This makes payment convenient, simple, and fast. Fintech companies can use this feature to make their customers pay quickly, reducing friction.

Building Trust Through Security, Regulation & Compliance

Another prominent challenge for Fintech companies is dealing with compliance regulations and legalities. And this also becomes why many lose their trust and loyalty amongst their customers as they deem security, privacy, regulation, and compliance.

loyalty amongst their customers as they deem security, privacy, regulation, and compliance.

Since WhatsApp uses end-to-end encryption to protect the data shared between businesses and customers, keeping them secure and private, FinTech using the platform only develops more customer trust.

Further, they can leverage hiring business service providers like Route Mobile, which has expertise in managing regulation and compliance within the platform for your company to build reliability and loyalty in the industry.

Conclusion

Customer engagement, retention rates, and customer experience are evidently some of the biggest challenges faced by Fintech companies. With that, WhatsApp became the most popular, high-response rate, and high-engagement messaging platform.

The latter can be the ground-breaking solution for Fintech in terms of consumer communication if it manages to leverage WhatsApp’s business to its utmost potential.

A good start can be consulting with a business service provider like Route Mobile, offering WhatsApp API solutions, smart & customizable chatbot, and many services tailored for the fintech industry. Contact our experts today to get started!

FAQs

How to Use WhatsApp Business API for Fintech Companies?

Fintech companies can utilize WhatsApp Business API to streamline, automate, and manage business messaging through a single platform and reap advanced features like real-time transaction updates, personalized customer support, enhanced security protocols, lead generation, compliances & regulations, and more.

How Fintech Companies Can Optimize Customer Communication?

The fintech industry must utilize messaging platforms with high response rates like A2P SMS and WhatsApp business through API integration, CPaaS, and effective communication methods like sharing financial education to consumers, personalized promotions, robust security, account notifications, updates, and better customer onboarding.

What strategies do Fintech Use to Engage Customers and Attract New ones?

Leveraging omnichannel communication and messaging, Fintech must incentivize customers with cashbacks and bonuses to attract new customers, offer valuable content to educate them and leverage social media marketing and messaging along with gamification strategies.