The million-dollar question is – Will chatbots become the savior in financial automation, or are they simply cogs in this giant machinery?

34% of consumers find AI chatbots in customer service actually very helpful. Many FinTech businesses reported faster complaint resolution with chatbot integration, proving their effectiveness in improving customer service.

Chatbots are more than just solutions for customer service. They directly help with major challenges of the FinTech industry in customer communication, such as customer engagement, retention, and simplifying finance for their customers. And this is directly proportional to the company’s revenue. So, now the only question is how to modernize fintech interactions by leveraging chatbots. In this guide, we dig deep into the benefits, use cases, and examples/case studies of these chatbots in the FinTech industry to understand how capable chatbots are in modernizing and automating customer interactions.

Table of Contents:

How Are Chatbots Beneficial To FinTech Enterprises?

Fintech companies have saved $7.3 billion in operational costs just by integrating chatbots. Also, they helped them to save 826 million hours of customer interactions. Undoubtedly, the benefits of chatbots in FinTech are unparalleled.

Let’s look at some more of these key benefits of chatbots:

Routine Task Automation

Chatbot excels in automating mundane, day-to-day, or repetitive tasks in FinTech, such as balance inquiries, password resets, transaction history requests, etc. It also helps businesses save billions of operational costs over the years.

Better Communication

Chatbots in the FinTech industry offer seamless communication between customers and companies through instant replies, conversational interactions, reduced wait times, and a more personalized approach.

Marketing Strategy Augmentation

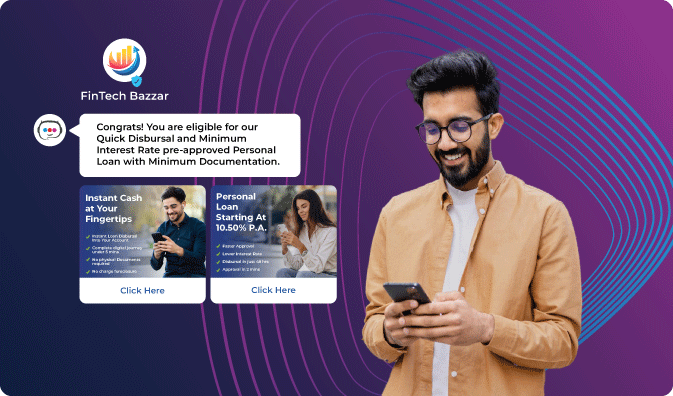

Chatbots are pivotal in personalized marketing campaigns for recommending products through customer data. AI-powered chatbots utilize customized marketing approaches or strategies to their customers at scale, making them more likely to purchase or at least engage.

Contextual & Personalized Conversation

Financial companies leverage data analytics, machine learning (ML), and sentiment analysis to engage customers in personalized and contextual conversations. As per McKinsey , Companies can generate as much as 40% revenue more from personalization.

Increase Convenience By Helping Your Customers

Chatbots bring ease of access, use, and convenience in banking, removing complicated procedures and paperwork.

It offers features like:

- End-to-End Account Management

- Chat-based customer support

- Access to Financial Services

- Open bank accounts online

- Change the PIN of debit and credit cards

- Complete KYC

- Apply for cheques, cards, and loans

- Quickly locate ATMs and branches

Such convenience offered by banks and other financial institutions to customers helps with an increase in customer engagement, retention, and even conversion.

Upsell And Cross-Sell

With personalization through customer data analysis, chatbots can upsell or cross-sell the most relevant products to customers and create a tailored offer that is more likely to succeed.

For example, chatbots can provide real-time suggestions based on the customer’s present requirements. When customers check their savings account balance, it can suggest they open a high-yield savings account through message bubbles highlighting the better interest rates.

Improved Customer Service

Since chatbots do not need any holidays, breaks, or sleep or have to go through a range of emotions, they are highly optimized for providing the correct information to customers whenever they need it. Automated instant replies, conversational interaction, and personalized communication make them even better at customer service.

Cost-Effective Solution

Chatbot has the potential to automate 30% of contact center staff’s tasks and customer support while managing 80% of routine tasks, reducing the operational cost as well as the time for the fintech enterprise.

Also Read: Maximizing Customer Engagement with the Best Chatbot Builder Platform

How FinTech Companies Are Integrating Chatbots?

Route Mobile’s Roubot allows FinTech companies to create their own custom smart bot with drag-and-drop flow builders.

Companies can add a live chat integration where the backend systems can be managed using a robust dashboard to track, analyze, and manage agent performances.

Here are some features of Roubot:

- Self-service chat builder

- Intent-focussed chat navigation

- Schedule on-the-go campaigns

- Ability to automatically qualify a lead on the basis of analytics

- Conduct A/B testing on bot flow

- Use real-time bot analytics

- Allow users to opt in or opt-out using keywords

- Customers can control the flow and update the date & time with ease

Such advanced chatbot tools are capable of all the following applications:

Available for Customer Support 24/7

Sensitivity and urgency go hand in hand with finance management. They can need support any day and any time. Only conversational AI-powered chatbots can be available 24/7 for customers to accommodate their

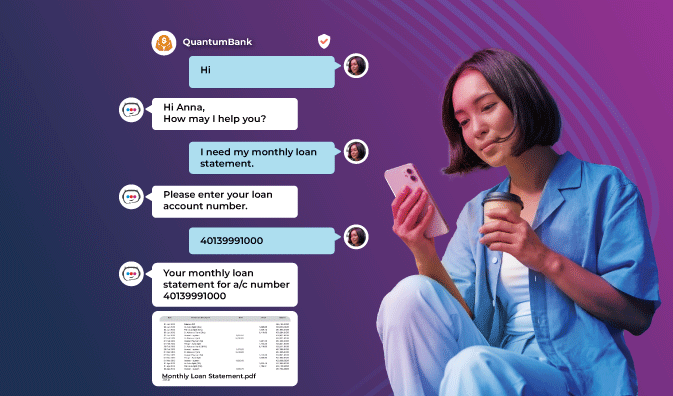

Assisting Customers in Digital Transactions

Chatbots in the financial technology industry assist customers in digital transactions. They help customers navigate several transactions with different limits to offer solutions that suit them best. These chatbots were also helpful in setting reminders, subscription payments, making investments, and paying bills.

Help With Account Management

Another step in modernizing fintech interaction is simplifying it and making it more convenient.

For example, they can use chatbots to provide account management features such as updating account information, verifying details, etc., so they do not have to constantly visit the bank website repeatedly to do such small tasks.

Providing Personalized Investment Advice

Leveraging Artificial intelligence’s components like machine learning (ML) and natural language processing (NLP), chatbots can analyze huge amounts of customer data, generating personalized investment advice as per their risk appetite, financial profile, budget, and other numerous financial factors.

Providing Actionable Insights Leveraging Analytics

AI chatbots in the FinTech industry can utilize large amounts of customer data and analyze it to generate actionable insights and strategies for the company. It will lay out the entire spectrum of the company, from its failures to optimize to challenges to focus on and to double down on its strengths.

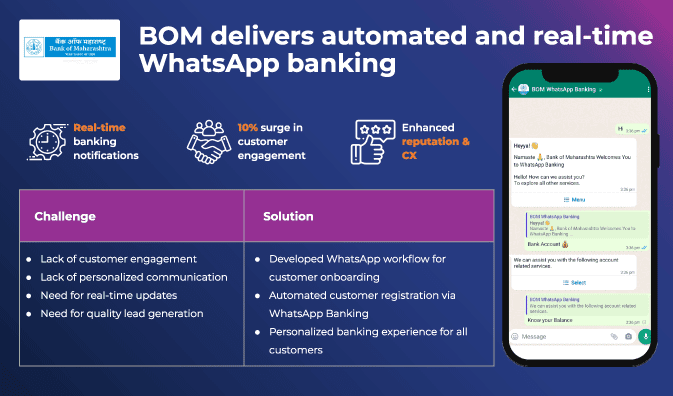

Case Study: WhatsApp Banking via Chatbot

Read More: Guide to choosing a chatbot that’s right for your business

Conclusion

The fintech industry has been rapidly growing through modernizing customer communication and interactions. Also, the banking and finance sector is undergoing major automation, chatbots, and AI adoption.

Taking a deep dive into the use cases of chatbots, their benefits, and case examples put things in perspective for businesses still on the fence about evaluating whether to utilize chatbot integration for their fintech enterprise.

We at Route Mobile’s CPaaS and smart chatbot integration help leverage chatbot to modernize their fintech interaction and customer communication to the next level. Book a consultation with our experts to get you started today!

FAQs

What Is The Use Of Chatbots In Fintech?

Fintech chatbots can automate customer service and set reminders for payments, subscriptions, and monthly bills. It offers personalized communication for a better customer experience using large amounts of extensive customer data, helping further in promotional campaigns, finance & Investment assistance, security, and more.

How Chatbots Help To Increase Financial Literacy?

Fintech chatbots simplify complex financial concepts for consumers through customized educational content. By asking questions and offering personalized advice, tips, and valuable insights, the customer understands how to navigate through their personal finances.

What Is The Future Of Chatbots in FinTech?

FinTech chatbots are crucial to customer communication, customer support, automation, and promotional marketing even today. As AI develops, it gets more sophisticated, and the application or use case becomes more capable, but its significance will only increase. Not to mention, chatbots will be the torchbearers of driving innovation and financial education in the industry.