Key Highlights

- Need for richer content and communication

- Secure and Reliable

- Enhanced customer satisfaction and engagement

- Quick delivery and acknowledgement of messages

- Intelligent Business Models

- Easy to use and understand

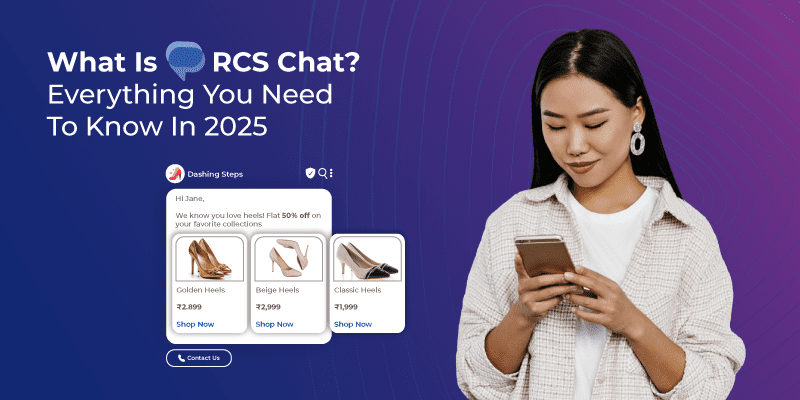

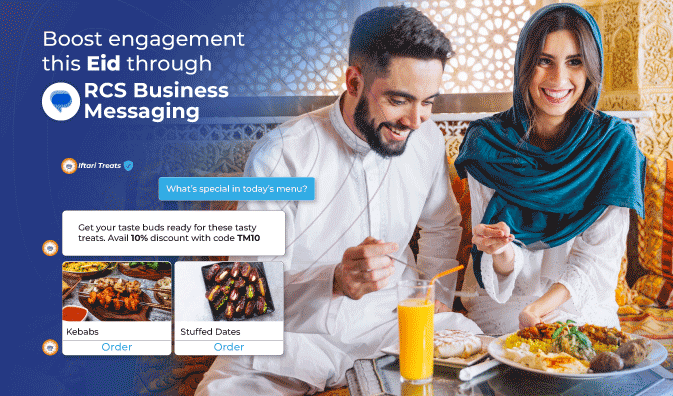

Higher expectations from a digitally and technologically loaded world has given birth to Rich Communication Services (RCS). While most of the human communities have been dependent on digital media, OTT channels, Email, SMS, and many others with assured security, RCS can be thought of as a game changer in the field of telecommunication and related services.

A further twist to RCS for businesses has brought in RCS Business Messaging for businesses to increase and improve the ways in which businesses communicate with their customers. It proffers brands and enterprises with an opportunity to increase their engagement with customers through business messaging using chatbots and artificial intelligence.

To put it more precisely, a brand or an enterprise has got multiple ways by which it can communicate with its customers. Some of the most commonly used modes include:

- Text/ Chat

- Social Media

- Voice

What if we bring the best of business messaging technology and banking on a single platform?

Banking is a gigantic industry which not only holds importance in the life of humans but also businesses. Inspite of more than thousands of banks across the globe, the average waiting time in a bank’s lobby is 4-5 minutes.

The era of digitization has enabled 50.8% of the global population to be online. Having said that, mobile banking is one of the most popular terms in the lives of many. Mobile banking is an act of making various financial transactions using mobile phones. Dated back in 2002, Mobile banking in India carried out transactions through SMS. While today, almost all banks have their own mobile phone applications.

These banks provide mobile banking services in the following ways:

- Mobile Banking over Wireless Application Protocol (WAP)

- Mobile Banking over SMS (also known as SMS Banking)

- Mobile Banking over Unstructured Supplementary Service Data (USSD)

Having said that, a report states that 61% of people carry out banking activities using their mobile phones while 48% have a dedicated banking app. Besides that, 49% of bank officials believe that traditional transactions are on the verge of getting replaced by digital banking.

The statistics state that 71% consumers downloaded a mobile banking app. According to a survey done in the USA, the most common banking activities that a consumer performs using mobile banking apps are as follows:

What makes RCS Business Messaging a hit for the banking industry?

With a huge number of active users base, RCS Business Messaging foresees a market worth of USD$74 billion by 2021. The newness of technology along with existing features of SMS, RCS is a new channel to gain traction in the worldwide market with a notable number of consumers already using its functions.

RCS Business Messaging is designed to provide banks with rich features as follows:

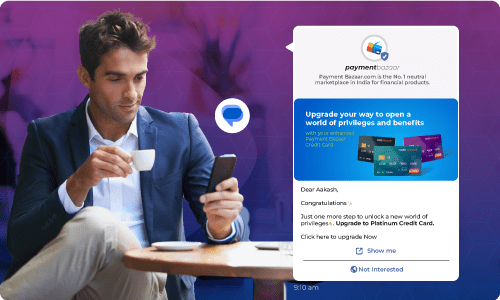

- Branded and verified business messaging

- Payments

- Request for opening a new account

- Bank & ATM Locator

- Find IFSC code

- Request for Cheque Book, Credit Card, Debit Card

- Customer Support

- Apply for loan

- Apply for insurance

- Bill Payments

- Integration with apps like calendar and maps

- High volume support with rich card carousels in a single message

- High-level authentication

Adding on to the list above, RCS Business Messaging comes with a bucket load of functionalities curated for banks with data such as deep-linking for web-based campaigns and/or emails. It also encompasses features like read recipients, delivery receipts, on-screen event tracking, and customized information of customers on the basis of their responses to a message.

Drilling down to customer behavior and responses using RCS helps banks in fetching data to optimize their campaigns. The research conducted by GSMA suggests that consumers are highly responsive to a well-structured and effectively designed RCS campaigns. Other than the above-mentioned merits, one of the most cardinal edges is its cost-effectiveness and eliminated need of investment in stand-alone applications.

The RCS Business Messaging substance

With a large number of businesses and brands dependent on SMS to communicate with consumers, it is extensively deficient in various ways. In contrast to this, considering the advancement happening in the field of mobile communication, providing brands, businesses, and their customers with cutting-edge features becomes paramount.

Along with that, businesses are estimated to send over 3 trillion SMS messages by 2022 yearly. Taking into consideration the magnitude of revenue generation and the volume of data to be transferred, it can certainly be implied that RCS Business Messaging has a wide scope in near foreseeable future. With that, a total of 86% of smartphones are expected to be RCS enabled by 2020. This opens a huge business messaging market that is projected to reach $74 billion by 2021.

Traditionally, banking activities have often required a lot of paperwork and documentation, resulting in a high order of commotion. Not only that, but it also demanded the physical presence of customers and investment of a lot of time. Although with the advent of the internet, the need for physical attendance for various banking activities has been substantially cut down; it still did not excise the need of using multiple applications for a single purpose. Adding on to that, mobile banking does serve the purpose to a certain extent but at the cost of consuming the mobile phone’s memory space.

Using RCS Business Messaging for banking and related activities brings in ease along with customer satisfaction. Having said that, the market has warmly welcomed RCS Business Messaging due to its supreme ability to serve its consumers with factors that were overlooked by older technology. RCS Business Messaging is for sure a novel technological leader in providing a list long features. But what makes it the most appropriate solution for the banking industry today?

Given its technical superiority, RCS Business Messaging has not compromised on its simplicity to use and understand. Some of its major factors that make it suitable for the banking industry are as follows:

Need for richer content and communication

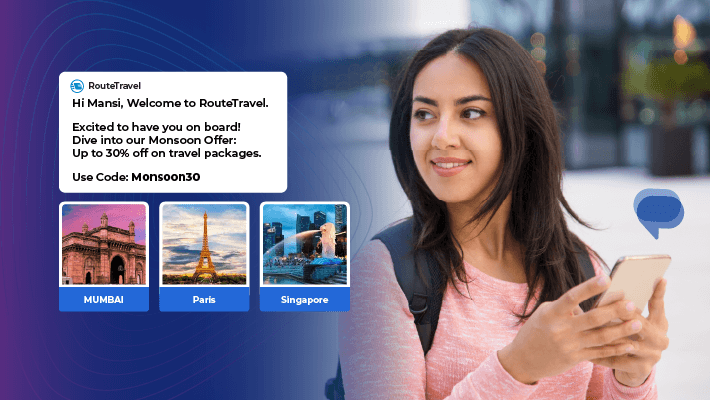

The ease in communication across geographies along with the ability to send multimedia messages has given rise to the need for richer media in multiple domains. RCS Business Messaging supports not only rich media but also richer content and communication. Banks can be greatly benefited as it will let them include a horizontally scrollable carousel of up to 10 vertical rich cards, branch locator, suggestive replies, and many more.

Secure and Reliable

An ever-increasing dependency and interference of digitization and technology have brought in a sense of fear in terms of data security amongst the consumers. Not neglecting the vitality of personal information involved during banking transactions, more than 60% of the consumers are worried about their information being misused. RCS Business Messaging aims to discard the feeling of data insecurity with its strong consumer preference for communication that happens from trusted companies and brands only. Additionally, it provides ways to make consumers believe that the channel they are using is reliable through its branding, customized logo, and a verified symbol against its name.

In order to provide a higher sense of security and reliability, it also lets one view privacy policy and terms and conditions of the bank.

Enhanced customer satisfaction and engagement

59% of people believe that interactive and intelligent models can improve customer engagement. A personalized message and way of communication has at all times resulted in the happiness of customers. While a huge chunk of consumers ends up feeling an insignificant part of the crowd, 61% of consumers show their interest in engaging with brands offering a personalized service. RCS Business Messaging is primarily engineered in a way that brings in a tinge of personal touch across the realms of a digital platform. Along with it, personalized service in most cases is guaranteed to elevate customer satisfaction.

Quick delivery and acknowledgment of messages

Typically, 90% of SMSs are read within three minutes in ideal situations. Whereas, the time spent between receiving and reading a message sent through RCS Business Messaging campaigns was just two minutes. RCS Business Messaging enables banks in identifying the nature of their customers’ response, time taken to respond, facility of read receipts, and choice of their suggestive replies. These factors not only make the delivery of the message quick but it helps in maintaining the crispness of the conversation between banks and their customers.

Intelligent Business Models

Engaging efficient and workable business models is the need of the hour which would ultimately lead to amplified customer engagement and hence retargeting. While the average rate at which users uninstall android apps on the very first day is 38%; this demands a model that would not only increase the number of customers using the service but at the same time ensuring that these customers continue with their interactivity.

With the help of intelligent business models, banks will be in a better position to suggest their customers with various products and services. RCS Business Messaging being a great technology in itself can help businesses benefit in terms of understanding the customer behavior, usual choices, and deeper insights.

Easy to use and understand

RCS Business Messaging is a phenomenal technology which comes with a great of technical superiority along with simplicity. By that, it means consumers can easily understand, use, and complete various banking transactions with utmost ease. Suggestive reply also acts as a guide for them to navigate across the platform.

The Working

Step 1: The system first does a capability check which checks whether the destined phone is RCS compatible or not.

Step 2: In case of successful capability check, RCS message is triggered. In case of failure, SMS is sent on the destined phone.

Step 3: In case of RCS Message successful delivery, delivery report is sent to the sender. In case of failed delivery, an SMS is sent as a fall-back mechanism.

Step 4: The process ends once RCS message is sent successfully or the process ends after an SMS has been sent even if it is undelivered.

Distinctly customizable, steady, conversational, and reliable, RCS Business Messaging is a power pack of features that proposes a chance to service its users with the innovative and engrossing user experience.

Tailored for a broad spectrum of businesses and verticals, RCS Business Messaging is the present and the future of communicating across geographies of the world!