Summary:

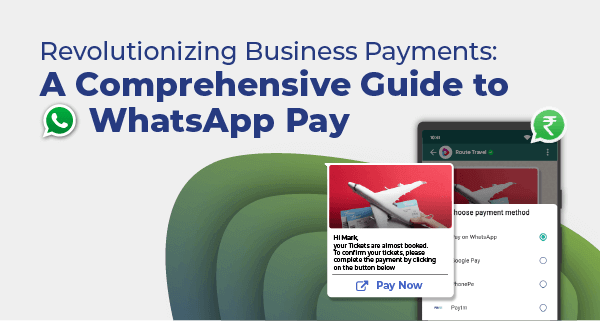

Previously, WhatsApp users had to leave the app and use third-party apps or websites to complete payments for any business. However, with the introduction of the new WhatsApp in-app payment feature, users can now make payments without leaving the app. WhatsApp Pay facilitates real-time bank-to-bank transfers, making the process easier and faster. Users can send payments using UPI apps, debit/credit cards, and more, without having to switch to another app or visit a website. The current upgradefbank to makes the payment process more flexible with third-party payment options for merchants on the app.

WhatsApp payment-to-merchant

Meta aims to attract more business owners and simplify digital transactions on its platform. Since the launch of the WhatsApp Business feature, customers have been actively using the messaging platform to shop, while businesses have been using it to showcase their products and services. Meta has expanded its payment service in India and Singapore.

WhatsApp pay feature is a beneficial addition for businesses seeking to simplify their payment process. Otherwise, redirecting users to external payment experiences leads to out-of-thread experiences that negatively affect consumer trust. Furthermore, there were apprehensions regarding app switch drop-off, latency, and the potential risk of fraud.

Businesses can offer easy in-chat payments

Around 300 million individuals utilize India’s Unified Payments Interface (UPI) to spend $180 billion consistently. By Q1 2024, India had the most WhatsApp users with 535.8 million active monthly users. This presents an opportunity for businesses to consider new transaction options to gain access to WhatsApp users, potentially resulting in increased revenue for those businesses.

Let’s take a closer look at WhatsApp Pay, how it works, its benefits for your business, and how to implement it.

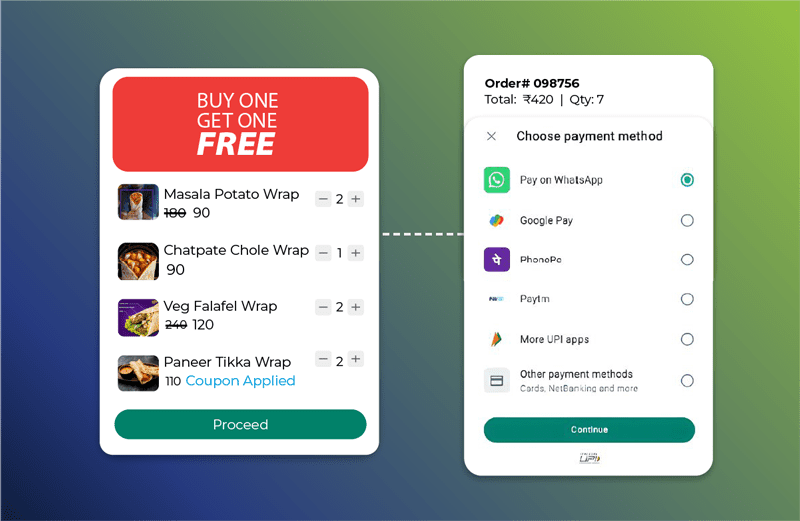

The WhatsApp Pay system works on WhatsApp UPI (Unified Payment Interface) and Payment Gateways. It can adapt to different use cases and cater to businesses of all sizes with unique requirements.

Despite involving specific transaction charges, WhatsApp Pay provides a unified platform to manage all business transactions in one place. A WhatsApp Pay bot can be set up to collect and process payments for businesses.

WhatsApp now allows users to transfer money to their contacts and make purchases through the app. With this new feature, sending or receiving money is as easy as sharing images or videos. Both regular users and business account holders can access this feature.

Payment requests can be shared in WhatsApp chat, and the status of the transaction will be displayed, whether it is completed, in process, or failed. Typically, WhatsApp payment transfers take up to two business days to be processed. An automatic refund is provided within 24 hours for failed transactions, and the transaction history can be accessed via Settings.

While individual use of the payment functionality within WhatsApp is free, businesses will be charged a fee per received transaction.

Benefits of WhatsApp Business Payments

The payments feature is not widely available yet, however, it is easy to see the potential benefits for eCommerce on a global scale. WhatsApp can provide an end-to-end, completely integrated customer buying experience by allowing conversational commerce for businesses.

The addition of payments to WhatsApp’s in-app customer buying journey can offer several advantages:

- Ease & Convenience: With WhatsApp Business Payments, businesses can receive payments directly within the app, eliminating the need for customers to leave the app to complete the payment process.

- Increased Trust: By offering a secure and reliable payment system, businesses can build customer trust and reduce drop-off rates.

- Improved Customer Experience: WhatsApp Business Payments allow businesses to streamline their payment process, resulting in a seamless customer experience.

- Extensive Network – WhatsApp is an incredibly popular channel, with over 2.78 billion active users. The projection is that this number will grow by 18% by 2025. You can tap into a vast user base and effectively reach all potential buyers.

- Cross-Border Transactions – With WhatsApp payments, you can easily conduct transactions globally. This is a perfect solution for countries without international payment options, and it opens up new opportunities for business growth and revenue.

Refer to the brochure to discover more benefits of WhatsApp Business Platform.

Some use cases of WhatsApp Business Pay

- E-commerce stores and online retailers can create product catalogs and receive payments via WhatsApp. Once a customer selects a product and adds it to the cart, a chatbot trigger can process the payment directly from the app.

- Service-based businesses, such as ed-tech companies or automobiles, can list their services and prices on WhatsApp and receive instant payments.

- Banking institutions offer support via their app and in-house teams, but few utilize customers’ preferred communication channels. One such feature to leverage is WhatsApp Pay.

- With in-app payment, customers can handle emergency healthcare with convenience, eliminating the need to queue up.

Conclusion

If you are a business owner in India, you should consider implementing WhatsApp Payments, as it can significantly improve your business transactions. With this feature, you can accept payments directly within WhatsApp and provide a seamless payment experience to your customers. Although there are still some challenges to consider, the benefits of WhatsApp Payments far outweigh the negatives.

If you want to learn more about what WhatsApp Business Platform can do for your business, please visit our WhatsApp Business Platform product page.

You can find more information and use cases there, or contact one of our experts to discuss your personal goals and strategies.