The festive season is a time of joy, celebration, and increased consumer activity. As businesses gear up for the peak season, finding effective ways to engage with customers becomes paramount. Two-way messaging is a powerful tool that has proven its worth in enhancing customer interaction and satisfaction. India stands second with 730 million users sending text messages. Companies can leverage these figures to enhance their outreach by employing the top five methods through which two-way messaging can elevate their presence during the holiday season.

What is IVR Solution

Thank you for calling “ABC Bank”. Press “1” if you are an existing customer, or press “2” if you are a new customer. Everyone must have experienced this as part of the phone banking process. IVR (Interactive Voice Response) is one of the most effective technologies to help a bank automate its interactions with its existing or potential customers.

A simple yet powerful and efficient solution that can help banks seamlessly communicate and manage the high volume of calls every day that are for common sales inquiries, customer service, collections, support, etc, to list a few. IVR can smartly & easily automate the process, save time, reduce cost, and save the customer agents from high volumes of calls.

According to recent research, the banking sector fulfills more than 70% of telephone calls received during the entire month over an IVR. Many small finance banks, private and public sector banks, and foreign banks have implemented IVR systems to reduce operating costs and create more customer self-service opportunities.

For telebanking facilities, customers need to register through IVR. They will receive a four-digit Telebanking Personal Identification Number (TPIN) similar to the PIN used for ATM transactions.

IVR Solution and Technology in Banking

With the rapid development of technology and solutions, especially within the banking sector, it is essential also to have the right security solutions, as data protection has become the need of the hour. Banking has been the most crucial industry that relies heavily on encryption and safeguarding information; thus with the excellent advent of technology, it has become imperative for businesses to incorporate the best practices to make the business successful.

Next, let us look at some of the most exciting and important use cases in which IVR solutions and technologies present themselves in the banking industry.

IVR Banking Solution Use Cases

Report lost/ stolen/ damaged/ reissue/ block card:

Should a card be lost, damaged, or stolen, customers need not call customer care numbers and frantically wait to be connected to an agent. They can report the same via an IVR as customers dial the helpline number, select the preferred language, and follow simple steps to block their card. After successfully submitting the request, they can receive a confirmation by SMS or mail as well. They can also leave instructions to issue a new card as a replacement.

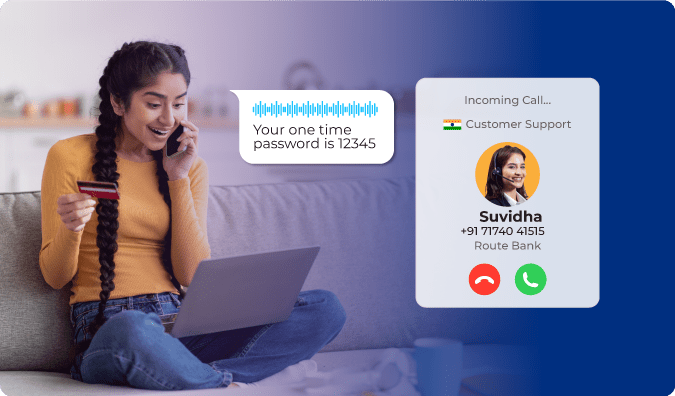

Send immediate fraud notifications:

Customers can be quickly notified through an IVR should a fraudulent transaction be detected in their accounts. Though an SMS notification can also address this, IVR gives the customer the option of being transferred to a banking agent immediately.

Also Read: Enhance Customer Experiences Through Voice Solutions

Product information:

Banks must constantly engage with their customers and educate them about their products and services—for example, Demat accounts, insurance policies, personal loan details, loans against shares, etc. IVR is a simple yet powerful solution as it can provide the desired information to the caller and transfer the call to a banking agent instantly to avail of the service.

Loan application and loan status:

Customers who have opted for bank loans can call IVR and seek the status of their approval and disbursement for the home loan, personal loan, or any other loan taken. IVR works on logic. It can easily redirect the calls to the concerned agents to discuss and understand the details of the loan process and repayments.

Easy login for service requests:

Customers can now easily log new service requests such as requests for an address change, name, mobile number, email ID, registration of mobile alert services, new PINs, queries for reward points, demat accounts, and many more. The days of waiting in long queues to speak with a customer service agent are passé. IVR aims to address the query instantly and promptly, increasing the banks’ overall efficiency.

Account related information & updates:

The IVR system can assist customers instantly & in a secure manner regarding their account balance summary or recent transaction history. Furthermore, they can check reward points balance and their card usage limit, set payment reminders and dates, and even check for the status of checkbook requests.

Activation/ Deactivation of cards:

The bank can offer a choice to its customers to activate or deactivate their cards without going to the ATM or visiting the bank for the same using an IVR. To ensure a secured process, the bank gives a unique TPIN (telephone PIN) for critical transactions or requests over an IVR. This minimizes the fraudulent transaction and adds the extra level of authentication to safeguard its customers

Surveys:

Banks can survey a recent customer interaction that has taken place in the physical bank. The IVR system will ask the customer about the last interaction with the bank employees. The questions can be tailored according to the answers given by customers. Thus, with the help of surveys, banks can enhance their customer service and improve customer satisfaction

IVR in Rural Banking

One of the leading banks has launched IVR for agriculturists and farmers to meet their financial needs right at their doorsteps. The main motive of this launch is that farmers can reach the banks over the phone to enquire about and avail themselves of their digital banking products.

They must dial the dedicated toll-free number and enter their unique PIN code number. The smart IVR then automatically maps the nearest branch to the farmer’s location to get the bank representative to reach out to them to address their needs. Rural banking initiatives are being taken by banks to ensure they can service customers with multilingual IVR solutions to speak with them in the preferred language of their choice.

Banks are aiming to have an efficient customer engagement system to address customer needs instantly. Smart IVR is an efficient system and the right fit for any bank’s customer-centric strategy. The system provides 24*7 access to their service, enhancing customer experience. It can reduce costs, increase operational efficiency, and benefit customers with secured and safe instant banking needs.

Conclusion

In the dynamic banking landscape, IVR emerges as a pivotal tool, streamlining customer interactions and bolstering operational efficiency. From safeguarding card transactions to providing instant service requests, IVR is reshaping the customer experience. With its 24/7 accessibility and strategic applications in rural banking, IVR is a cornerstone in the industry’s pursuit of customer-centric solutions. Its ability to enhance services, reduce costs, and ensure secure transactions cements IVR as an indispensable asset for modern banking practices.

For more information, get in touch with our experts by clicking here